The context

Credit Karma launched in the UK with a system of basic alerts in place, sent to us on a weekly basis by the credit reference agency we use, to be forwarded on to our users. To help our users stay on top of their finances in real-time, we wanted to also use our own technology to alert users immediately when there was something new on their credit report.

The challenge

We wanted to make sure users weren’t overwhelmed by the volume of emails they were receiving from us. It was a fine line to tread because users were already receiving an aggregated alert email on a weekly basis, plus marketing and education emails for those opted in.

We recognised that a substantial increase in volume could damage engagement with all of our other emails too.

What we did

The product manager, the designer and I went through the different instant alerts we might be able to send and sorted them against a framework of urgency, helpfulness and actionability.

This helped us establish which types of alert to prioritise and send instantly. The ‘shortlist’ actually turned out to be pretty long, as we felt many of the alerts could be useful simply to help users spot fraud.

For example, if a new credit card is opened and the user knows about it, that’s fine. But if they didn’t apply for a new card, then it’s something they should contact the lender about straight away to help tackle potential fraud.

To overcome this, we developed a hierarchy within the instant alerts we’d chosen. We assigned a priority level to each of the shortlisted alerts and worked with our engineering team to ensure the system could be set up to only send one instant alert – the highest by priority ranking – even if the user had triggered more than one.

Changes on a person’s credit report tend to impact their credit score, so the score is the top-level indicator that something positive or negative has happened. Since that tends to be easiest for people to interpret, we decided to put score changes as the top priority and direct people to the product where there’s lots more information about why it’s changed.

What I did

I wanted to make sure the content in the alert emails was helpful and digestible at a glance, but ultimately encouraged people to come to the product where they can really learn about the impact of the change on their finances.

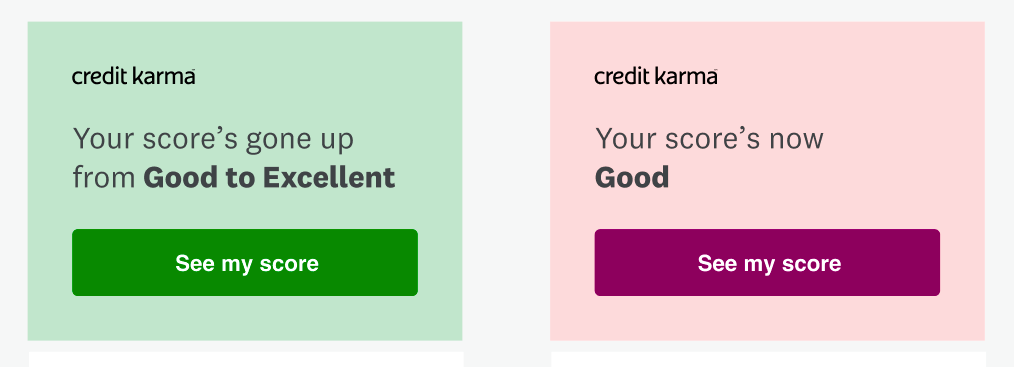

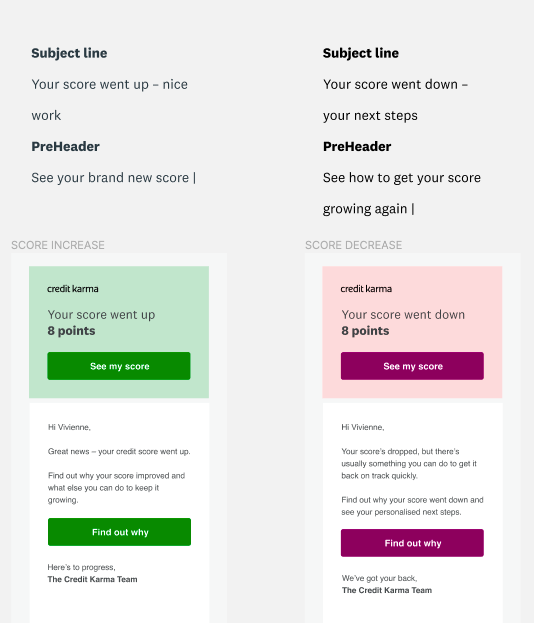

The voice principles I developed for Credit Karma are all about celebrating or commiserating with people on their ultimate journey towards financial progress. So I wanted to make sure I took the opportunity to celebrate with users whose scores had gone up or total debt had come down, while helping those who had a small setback to feel positive about getting back on the right track.

In each of the positive instances, I chose terms like ‘Nice work’ to recognise the person’s efforts so far, but since changes can be fairly minimal eg 3 points, it didn’t feel right to go too overboard with the celebration.

I chose to only reflect the score change in points rather than showing the score itself because I felt this would encourage people to be more curious about their score and why it’s changed, putting them in the right frame of mind to visit the product, learn more and make an educated choice about what to next and in the future.

The outcome

The new alerts improved engagement with the credit improvement part of our product by 35%, helping to bring 1 million more users back to the product each month. We monitored user feedback to gauge whether people felt overwhelmed by the overall volume of emails they were receiving.

Our careful approach to balancing cognitive load with boosting product engagement helped shape the product culture of notifications initiatives that followed, ensuring user needs were kept front-and-centre.