Every credit reference agency has a set of factors that go into measuring how credit-worthy a person is at any given time. This system was never intended to be presented to the person being measured. That means it can be quite difficult to interpret and understand what to do to improve how credit-worthy you are.

The challenge

We wanted people to truly be able to understand what shape their credit-worthiness is in today and know what to do to improve it, since our research showed people struggle with this. Some existing apps offered a very light version of these credit factors, but we wanted this to be the cornerstone of our offering, since Credit Karma is all about helping people make financial progress.

What we did

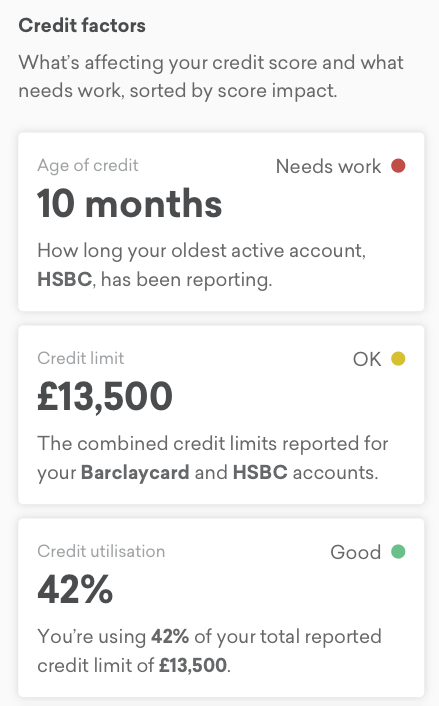

When I joined the team, they had already come up with a traffic light system to help people interpret their status for each credit factor as a glance. These cards are tappable and reveal a factor detail page that gives the user personalised guidance on how to improve that factor.

What I did

When I dug into the logic a little, it became clear that the system wouldn’t work well. The main problem was the ‘Needs work’ status.

While most of the credit factors could be worked on and improved in some ways, there were a few that weren’t that simple. One of the factors simply relates to how long your oldest account has been open for. The ideal state is to have had an account that’s been open for more than 6 years, as lenders see it as a sign of confidence and stability in a borrower.

If it’s been open for less than a year, you’d be in the ‘Needs work’ category, but really all you can do is wait until your credit card ages. It’s you against the clock. So ‘Needs work’ wasn’t quite right.

‘OK’ and ‘Good’ felt like they were hitting the mark most of the time, but they did nothing to motivate people to see what they could do to improve that factor.

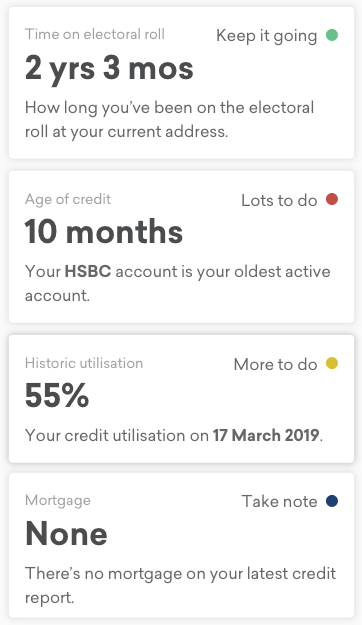

I started to play around with different variations of the badging system, flipping the approach to focus on what people needed to be doing about the factor, injecting a sense of urgency and the potential for progress.

After a lot of trial and error, it became clear that there was no perfect wording to solve the problem. The way the system works isn’t designed for people to interpret, so all we could do was present it as clearly as we could.

I ended up with four states:

I replaced ‘Good’ with ‘Keep it going’ because many of the factors required continual upkeep to remain in the best possible place. I felt this would strike the right balance between giving someone a positive moment and encouraging them to dig a bit deeper and find out how to stay there.

‘Lots to do’ and ‘More to do’ help orient users as to their status and give them the motivation to figure out what they need to do next, without feeling overly negative.

Working my explorations through with stakeholders, we also agreed that the three traffic light statuses wouldn’t cut it for all instances and a fourth would be required to take care of instances where there was nothing we could reasonably ask someone to do. For example, having a mortgage is good for your credit, but we would never expect someone to get a mortgage just to boost their credit. So that’s where ‘Take note’ came in.

The outcome

On the whole, I feel proud of this project and the team because we pushed ourselves to solve something to serve our users in the best way possible, in spite of a rigid system that was never designed to be accessible. We were able to instil Credit Karma’s voice as a financial coach and focus people on improvement.

App store reviews consistently mention the credit factors as a truly useful feature that helps people track their status and demystifies what sits behind their credit rating.